Washington State Estate Tax Law Changes

You may already know that Washington is one of the 12 states that has an estate tax.

Washington’s Estate Tax Exemption Increased from $2.193 Million to $3 Million

Washington's estate tax law has changed, effective July 1, 2025, to increase the estate tax threshold to $3 Million. Everything above the threshold is subject to the estate tax.

The prior estate tax threshold was $2.193 Million, which it had been since 2018. The threshold was intended to increase with inflation in accordance with the CPI for the Seattle-Tacoma-Bremerton metropolitan area. That CPI stopped being calculated in 2018 causing the estate tax threshold to stay stuck at the 2018 numbers.

The increase to $3 Million is intended to reflect the inflation that occurred since 2018. Also, the calculation is now tied to the CPI for the Seattle metropolitan area so it should increase with inflation in future years as was always intended.

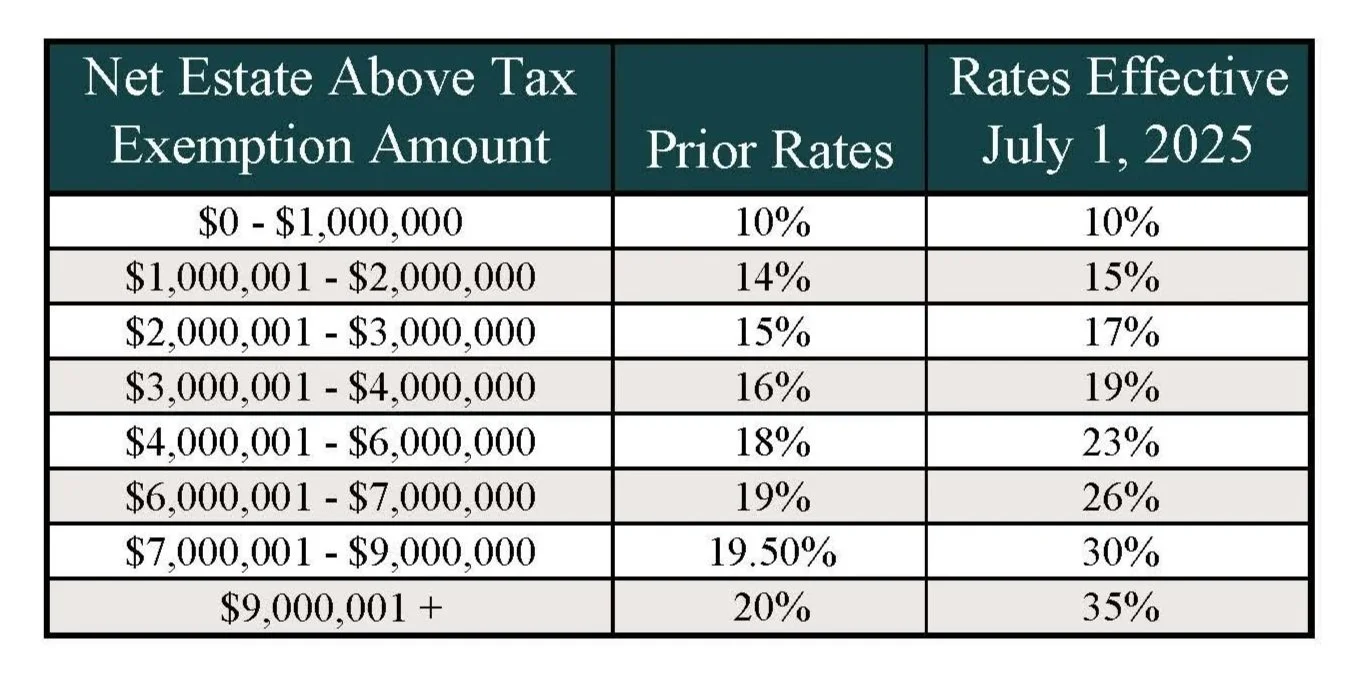

Washington’s Estate Tax Brackets are Increasing:

Beyond correcting the inflation calculation, the new law also increases the estate taxes that will be owed if your estate reaches the higher brackets. The table below shows a side by side comparison of the current rates and the new rates.

These brackets are for your assets that exceed the limit. For example, under the prior rates, that first bracket is for the first $1 Million that exceeded your exempted $2.193 Million. Under the new rates, the first bracket is for the first $1 Million that exceeds your the new exemption amount - $3 Million.

Structuring Around the Washington Estate Tax

There are options to structure around the Washington estate tax, but they need to be done while you are still alive. The punchline is that the best way to avoid the estate tax is to not have the money - so spend or gift before you pass away. However, the way in which you gift may include certain trusts or other structures that allow you to ensure your legacy has an impact for many years to come.

A common opportunity for estate tax structuring is when a married couple exceeds the Washington estate tax threshold. In that scenario, there are methods available to prevent the surviving spouse from "inheriting" 100% of the assets, causing an estate tax on more than is necessary.

For example, if Pat and Sam have $4 Million in assets then we could say they each have $2 Million, and are therefore below the threshold. However, if Pat's and Sam's estate plans say give everything to my spouse when I pass away, then the surviving spouse would be sitting on the full $4 Million pot, causing a Washington estate tax when the survivor passes away.

With proper structuring, we can create a set up where the "half" that belongs to the first spouse to pass away is placed into a trust for the benefit of the survivor, but is not considered part of the surviving spouse's estate. In the Pat and Sam example, when the survivor passes away, they still only have their $2 Million and there's no estate tax.

The same concepts apply if the assets are higher numbers. We can carve off a portion of it to not be part of the surviving spouse's estate for purposes of Washington’s estate tax.

If you want your estate plan reviewed you can always reach out to Schedule a Consultation.

If you want to read more estate planning tips, you can check out my blog.

Please note, careful consideration should be made when using this gifting strategy as there are many other types of taxes that could be implicated. Make sure you are using a trusted advisor.